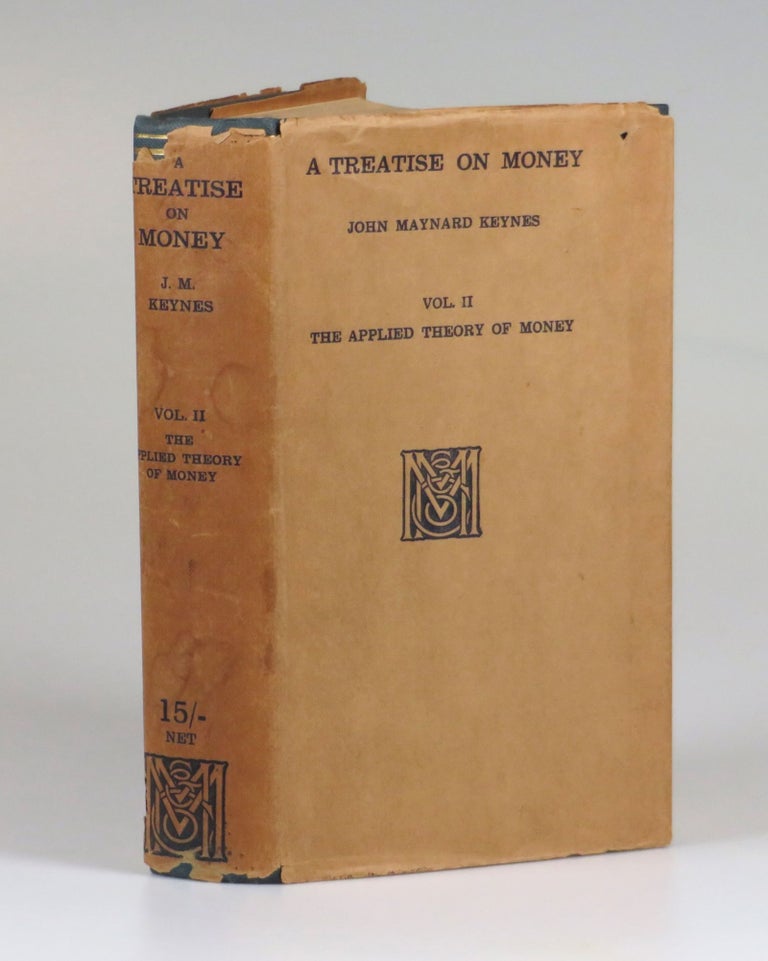

A Treatise on Money, Volume II: The Applied Theory of Money

London: Macmillan and Co., Ltd., 1930. First Edition. Hardcover. This first edition of the second and final volume of A Treatise on Money is quite scarce thus, magnificently clean and jacketed. Published on 24 October 1930, Treatise was “the first of Keynes’s two major contributions to economic theory”.

This copy approaches near fine condition in a good dust jacket. The binding is unsullied, square, bright, and tight with vivid spine gilt, sharp corners, and only trivial shelf wear to extremities and a touch of mottling to the upper front cover and lower right spine. The contents are notably bright and clean with a crisp, unread feel. We find no spotting. The sole previous ownership mark is an inked name and “1931” date on the upper left front pastedown. The pages show only mild age toning and light soiling. The rarely-seen dust jacket has shallow losses to the spine ends and the lower rear hinge, none appreciably affecting spine print, with lesser wear and fractional chipping to upper front and rear faces. The spine shows no significant toning, but does suffer some light soiling and a few faint moisture stains. The jacket is protected beneath a clear, removable, archival cover.

In his Treatise, Keynes's focus was “on money and prices rather than on output and employment.” Keynes’s “full study of the operation of the monetary system, national and international”, drew on an essay about Index numbers that had won him the Adam Smith Prize two decades earlier. Nonetheless, “Though a liberal, he was no believer in laissez-faire; nor was he ever tempted to extreme reliance on the state. What he kept writing about was ‘management’.” It is a word that appears again and again in the headings of Chapters of Book VII”, which is the final section of the work and of this second volume, comprising Chapters 31-38.

John Maynard Keynes, Baron Keynes (1883–1946) was, at once, “philosopher, economist, editor, pamphleteer, company chairman, college bursar, patron of the arts and intimate friend of writers and artists, government spokesman and adviser.” Nonetheless, “It is primarily as an economist that Keynes is remembered” and in which his influence is most conspicuously manifest.

Keynes began his fuller academic treatment of monetary theory in the summer of 1924. During the next six years before his two-volume Treatise was published, “Keynes was rethinking his theories of economic fluctuations, writing parts of the book at intervals while occupied in many other directions.” Among these was Keynes’s vigorous opposition to Britain’s return to the gold standard under then-Chancellor of the Exchequer Winston S. Churchill. In the final year before publication came the Wall Street crash. “In November 1929… Keynes was appointed a member of the Macmillan committee on finance and industry, set up by the Labour government to report on how the banking system affected the working of the economy. Two months later he was asked to join the Economic Advisory Council, made up of senior ministers and an assorted group of outside experts…” Publication of A Treatise on Money came “simultaneously with the end of the committee of economists”. (ODNB)

The work was timely and relevant in a world facing The Great Depression. Keynes’s “most famous work, The General Theory of Employment, Interest and Money, was published in 1936. But its 1930 precursor, A Treatise on Money, is often regarded as more important to economic thought… Keynes, in Treatise, created a dynamic approach that converted economics into a study of the flow of incomes and expenditures.”

Important arguments posited in the Treatise include the reasoning that, during a depression, the best course of action is to promote spending and discourage saving and the notion that “governments should solve problems in the short run rather than wait for market forces to fix things over the long run.” Deficit spending on labor-intensive infrastructure projects and other such Keynesian policies would play a large role in social and economic stabilization during the Great Depression. (IMF). Item #007042

Price: $1,000.00